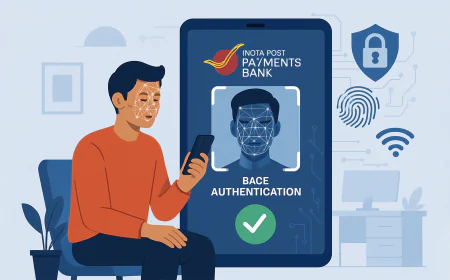

IPPB Rolls Out Face Authentication for Inclusive Banking

India Post Payments Bank introduces facial recognition for Aadhaar-linked transactions to boost secure digital access.

India Post Payments Bank (IPPB) has launched a new Aadhaar-based face authentication feature for customer transactions, marking a significant leap in inclusive digital banking across India. Announced on August 1, 2025, this initiative is especially aimed at helping senior citizens, people with disabilities, and others who face difficulties using traditional biometric methods.

Developed in collaboration with the Unique Identification Authority of India (UIDAI), the face authentication feature allows customers to carry out banking transactions simply by scanning their face. This eliminates the need for fingerprint scanning or one-time passwords (OTPs), making banking more accessible, secure, and user-friendly.

“Aapka Bank, Aapke Dwaar” — Now with Face ID

Speaking at the launch, IPPB’s Managing Director and CEO Shri R Viswesvaran said, “Banking should be dignified and inclusive. Our Aadhaar-based face authentication ensures that no customer is excluded due to biometric limitations or OTP barriers. This isn't just a technical upgrade — it's a major step forward in scaling true financial inclusion.”

How the Face Authentication Works and Why It Matters

The feature enables customers to authenticate their identity via facial recognition linked to their Aadhaar profile. This technology is embedded into IPPB’s mobile platforms used by postal workers across the country, ensuring doorstep banking even in remote areas.

Key Advantages Include:

-

Inclusive Design: Ideal for the elderly and differently-abled who may struggle with fingerprint verification.

-

OTP-Free & Contactless: Offers a hygienic, fast, and frictionless banking experience.

-

Secure Access: Ensures safe authentication without the need for physical contact or passwords.

-

All-in-One Banking: Can be used for services like account opening, fund transfers, balance checks, and bill payments.

Supporting Government Missions

This nationwide rollout aligns with the Government of India’s Digital India and Financial Inclusion programs. It also supports IPPB’s mission to bring secure, affordable, and accessible banking to the doorstep of every Indian — especially those in underserved and rural areas.

.jpeg)